Real Property Levy Codes

Overview

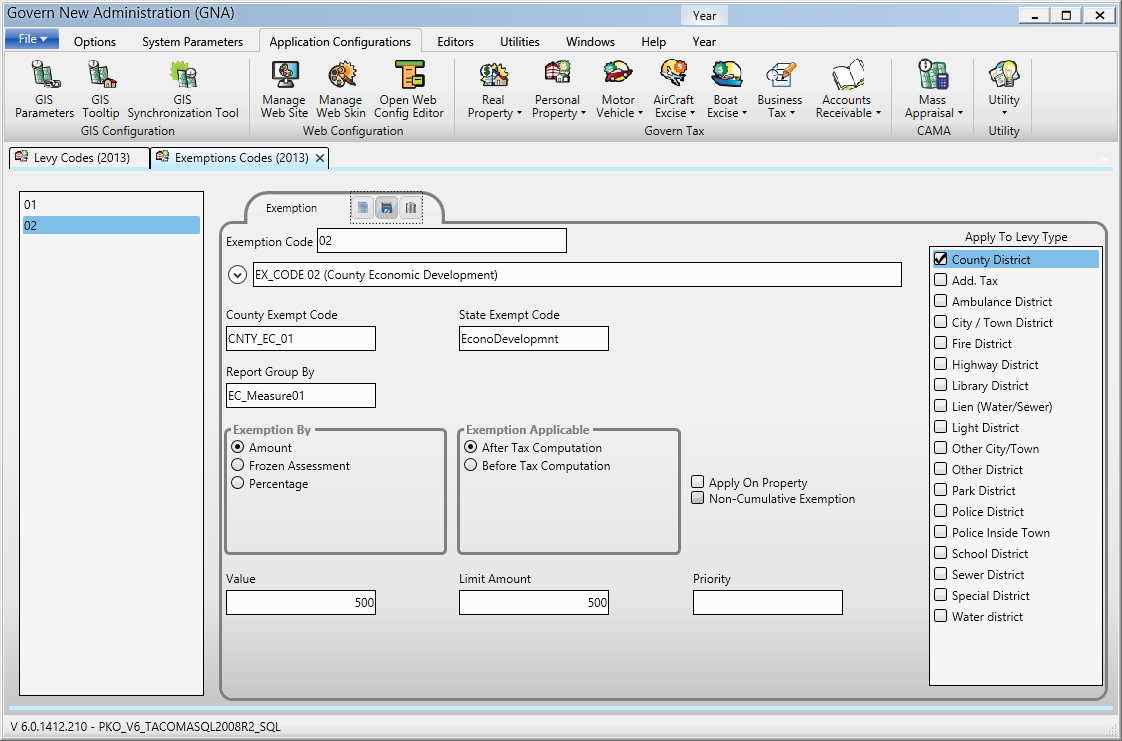

The Real Property Tax Levy Codes form is used for creating and maintaining tax levies. The setup includes defining the computation methods, rate types, and amounts. After creating tax levies, create Levy Groups using the Levy Group Parameters (Real Property) form. The use of levy group facilitates data entry. The user adds a levy group on the Tax Assessment tab and a levy record is automatically created for each levy in the group. See Levy Group Definition (Real Property).

Accessing the Real Property Levy Codes

To access this form:

- Launch GNA.

- Select Application Configuration > Govern Tax > Real Property > Levy Codes.

Tax Levy Action Buttons

Creating a Levy Code

To create a new levy code, click the New icon and enter the required information. The Exit button switches to the Cancel icon so that you can delete new information without closing the form.

Copying a Levy Code

Click the Copy button to duplicate the selected levy code. This saves time and facilitates data entry if you are creating multiple codes.

All fields on the form are copied with the exception of the Code. This is a unique identifier and a required field.

Note that the Alternate Code is copied.

Saving a Levy Code

Click the Save icon to save a new levy record or modifications to an existing one.

Deleting a Levy Code

Click the Delete icon to remove a levy code. A confirmation message is displayed. Click Yes to continue.

Exit

Click the Exit icon to close the form. A confirmation message is displayed if there are any unsaved modifications. Click Yes to save your modifications. Click No to close the form without saving the new information or Cancel to return to the Tax Levy Codes form.

Tax Levy Codes

Year

The Year field displays the fiscal year set in Govern Admin

To change the default year or to view levy codes from a different year:

Select Edit > Set Table Year on the Tax Levy Parameters form.

Enter a new year in the text box and click OK.

Year

Tax Levy Groups are saved by year. By default, this field displays the current year of the computer on which GNA is installed. To change the year, enter a new year in the field and click [Enter] on your keyboard.

Levy Code

Enter the Levy Code to be used with this record.

Alternate Code

Enter an alternate code to identify the record. Typically, this is used for reports. You could use this field for a regional or state code.

Click the drop-down arrow beside the Levy Name field to display all the short and long description fields.

Enter a name for the levy code.

Short Description

Enter a description to be used for fast data entry and look-ups if space is limited on forms.

Long Description

This description will be displayed for look-ups, on forms and normally used for reporting.

| NOTE: If you enter a name for levy code in the name field and click Save, the short and long description fields are automatically populated. |

A/R Class

Select the A/R Class Code from the drop-down list (Table: VT_USR_AR_CLASS). This list displays the A/R Class Codes created for the Govern Tax Real Property subsystem. For further details on A/R Class Codes, refer to the Accounts Receivable guide.

Levy Type

If required, select the Levy Type from the drop-down list (Table: VT_USR_ LEVYTYPE). A levy type is an optional category that can be used for grouping levies. It can be used for reports. You can apply exemptions to levy types. See Exemption Codes on page 38. You can apply levies to levy types. See Tax Levy Parameters (Real Property). You can also apply even installments by levy type. See Even Inst. on Levy Type.

Bill Sort Order

Enter the sorting order to be used when printing Govern Tax Real Property bills. This is a numeric field.

Computation Method

Select one of the following methods according to how you want to compute the levy:

Base X Rate: for the billing process.

Fixed Rate: for special charges and fees.

Override: for one-time tax definitions, such as interest and variable adjustments, such as abatements. These are deleted from the master file during the end-of-year process. See Compute Levy and Exemption.

Rate Type

Select a Rate Type only if the selected computation method is Base x Rate.

Computation Information

Amount

Do one of the following, depending on the Computation Method selected:

For Base x Rate, enter an amount.

For Fixed Rate, enter a rate.

For Override, the field is disabled. The value is entered on the data entry form in Govern.

Last year + / – ($,%)

This field is used for the increase or decrease from the previous year. It can display an amount or percentage and this value can be calculated and displayed automatically or entered manually. See Prior Year Rate Increase / Decrease.

Minimum Levy Amount

Enter the minimum credit amount to be calculated in this optional field.

Maximum Levy Amount

Enter the maximum amount for a levy if required. This is an optional field; leave it blank to accept unlimited levy amounts.

| NOTE: This parameter accepts a negative value; so that you can generate a credit on tax bills. If you are entering a negative value, enter the number that will generate the maximum credit. |

If the amount levied is greater than the maximum, this value is displayed in the Total Net Tax field on the Tax Assessment Maintenance form.

If a negative value is entered and the amount levied generates a credit greater than the allowed maximum, the value in this field is displayed as a negative amount in the Total Net Tax field on the Tax Assessment > Levy user form in Govern.

If the amount levied is greater than the maximum, this value is displayed in the Total Net Tax field on the Tax Assessment Maintenance form.

If a negative value is entered and the amount levied generates a credit greater than the allowed maximum, the value in this field is displayed as a negative amount in the Total Net Tax field on the Tax Assessment > Levy user form in Govern.

| NOTE: This field is enabled for the Base x Rate Computation Method only. |

Base Column

If the computation method is Base x Rate, do one of the following:

Select a column from the Base Column drop-down list. This column will be used in the calculation of the Base for the selected Levy Code.

Leave this field blank to use the default Total Assessment Value (VA_TOTAL_ASSMT) in the calculation.

Creating a New Base Column

- You can also create a new column for the calculation of the levy. In order to populate the new field, you can link it to a calculated field in the Business Entity Designer.

- To create a new Base Column for the computation:

- Click the button.

This opens the New Database Fields Creation form for the TX_RE_ASSESSMENT table. The new column name begins with the prefix VA and the underscore character (_). Enter a maximum of eight additional characters. - Enter a description for the column.

- Select a column type from the drop-down list:

Currency

Date/Time

Memo Field

Numeric no decimals

Numeric with decimals

Text (alphanumeric) - Click Save.

When you create any new column, it is added to the top left of the user form. You can move it to any position using the Object Dragging Mode and change the label with the Field Setup Mode feature. Refer to the Super User guide for complete details.

This procedure adds the field to TX_RE_ASSESSMENT table in the database. If you are linking this field to a calculated field, open the Govern Business Entity Designer (BED), create the link, and assign the properties.

To assign properties to the new field:

- Launch the Business Entity Designer (BED).

- Open Business Entities in the Model Explorer.

- Select the Tax Assessment entity.

- Verify the following properties under Data Mapping

Settings:Data Mapping

Type: Relational Database

Datasource: Select the name of the datasource you are configuring.

Table: TX_RE_ASSESSMENT

Column: Select the column you created in GNA.Identity Type: None - Click Calculated from the Predefined Content field to link the new column to an expression.

- Select Expression from the Expression Type field.

- Click inside the Expression value field to open the Expression Editor and create your expression.

- Click Save.

103-re-parm-Levy