Self Reported Business Tax – Filings

Overview

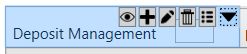

Under the Business Tax Filing tab, the Filing Information sub tab is used to enter collection information, to view totals, interest payments, and levies for each Business Tax record. The Filing Information tab may also be referred to as the Business Tax Data Entry form.

Display A/R Information by Period

By default the information that is displayed under the Self-Reported Tax Filing tab > A/R Information group, is obtained from (Table: ST_FILING_MASTER). When a filing is posted, by default, the A/R Information is displayed by AR_ID. In Govern for .NET, when required, the Display by Period option, when selected will display balance information by the ST_ID. Deselect the option to view the balance by the AR_ID. See Self-Reported Business Tax Display A/R by Period

Group Adjustment (All Years)

This enhancement was released in version 6.1.1706.

There is a functionality in the Govern A/R Inquiry form that allows the user to reverse for a parcel, multiple transactions for multiple years with a single process. See A/R Group Adjustment (All Years)

Allow Creation of Negative Levies

This enhancement was released in version 6.0.1702 / 6.1.1702.

Enabling this option will allow users to enter a negative amount in the Self Reported Tax Filing Information form, thereby creating a negative levy. When the return is posted to the A/R the levy will be created as a negative invoice which will credit the balance. See the user documentation below for details.

101-st-fea-009_Allow_Creation_of_Negative_Levies.pdf

SRT Transfer Filing

This enhancement was released in version 6.0.1605 / 6.0.1605 (June 2016).

When users erroneously file under the wrong period, there was no straightforward process available to transfer the filing. The Govern system now allows a transfer to any Unfiled Filing Period with the same Category. Refer to the document below for details.

101-st Allow Creation of Negative Levies.pdf

See also

- Tax Account Maintenance

- Tax Filing

- Tax Filing Occasional

- Tax Name & Address Mailing Index

- Business License to Name

Related Topics

Header or Note Setup in SRT Filing Record

101-st-frm-002_Self_Reported_Tax_Label_Setup.docx

101-st-frm-002

[rating]