Version 6.0 | Version 6.1 Scheduled for 6.0.1611

Overview

Use the Govern OpenForms Cash Collection user form to accept advance or voluntary payments on Real Property and Personal Property tax accounts.

An Advance Payment or Voluntary Payment (VP) is an amount that is paid before a bill is received. This type of transaction can be useful for taxpayers who would like to cover bills during a predicted absence.

When a voluntary payment is saved, an Open Cash Credit (OCH) is automatically generated. When you post the Voluntary Payment (VP) using the Cash Collecting Posting batch process, the Open Cash Credit (OCH) is also posted. It is applied on the next bill generated for the account. The VP and OCH transactions can be viewed in the Detail section of the A/R Inquiry form, both before and after they are posted.

This wiki page describes the following:

- Administrative Setup

- Configuration

- Setting Security on Cash Collection Parameters

- Processing a Voluntary Payment

- Viewing the Voluntary Payment Transaction in A/R Inquiry

- Posting the Voluntary Payment

Documentation

To view the information on this page in pdf format, click on the following link.

CashCollectionVoluntary.pdf

Related Information

For further information, see the Cash Collection Form

Business Rules

Accounts

In Govern OpenForms, a Voluntary Payment can be applied on an account from any year, regardless of whether there is a balance or not.

An AR_ID must already exist for the person or property associated with the payment.

In Govern OpenForms, a Voluntary Payment can be applied on a transaction from any year, regardless of whether there is a balance or not.

Subsystems

The voluntary payment option is available to Real Property and Personal Property tax.

Administrative Setup

General Parameters

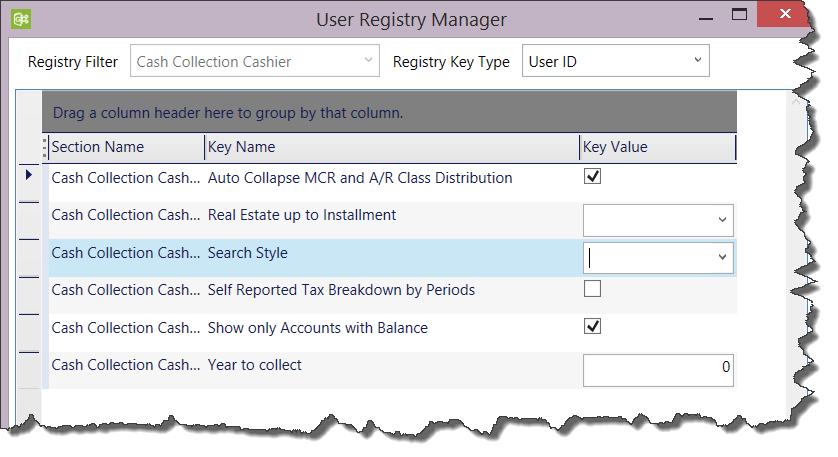

The following User Registry parameters are specific to Cash Collection:

- Show Only Accounts with Balance

- Year to Collect

These parameters are available on the User Registry Manager in Govern and in GNA > Application Configurations > Accounts Receivable > Cash Collection Parameters.

Showing Transactions for a Specific Year Only

In Govern OpenForms, Voluntary Payments can be accepted for any year. If you want to display existing transactions for a specific year only, perform the following set in the Cash Collection Parameters available in Govern.

To create a filter by year:

- Launch Govern.

- Open a Profile that contains the Cash Collection form.

- Select the Payment Data Entry tab.

- Click the Cash Collection Cashier icon.

The Cash Collection Options form opens.

- Enter the year that corresponding to the transactions that you want to display in the Year to Collect parameter.

- Click Save.

Print Receipt

Follow the instructions for setting up the Print Receipt report as described in the Cash Collection documentation. See Print Receipt.

Configuration

The Cash Collection form contains custom search parameters for Real Property and Personal Property voluntary payments.

To view or modify the configuration for these custom searches:

- Launch the Govern OpenForms Designer (OFD).

- Open the Cash Collection form (CC01).

- Select the Payment Data Entry entity.

- Select the CCPaymnetDataEntry_Control.

- Expand Properties > Misc in the Properties explorer.

- Select AR008 – Accounts Receivable in the A/RInquiryForm parameter.

- Select arPayment – A/R Payment Data Entry in the SearchGroup parameter.

- Select ppPersonalP – Personal Property Search in the VpSearchGroupForPP property.

- Select pcProperty – Property Search in the VpSearchGroupForPP property.

- Click Save if you have made any changes.

Setting Security on Cash Collection Parameters

The security settings for Voluntary Payments are the same as for any Cash Collection transaction. This section describes those settings:

To view the security settings for Cash Collection:

- Launch the Govern OpenForms Designer.

- Open the Cash Collection form (CC01).

- Select the Payment Data Entry entity.

- Select the Security icon.

- The Payment Data Entry form includes the Cash Collection Payment Data Entry custom control, CCPaymentData_Control.

As with all security permissions in the OFD, the majority of these settings are enabled by default. The option to Apply Late Charges is the exception.

The settings are as follows:

Can Edit Payment

Can Edit Principal

Can Edit Interest

Can Edit Penalty

Can Edit Fee

Can Edit Discount

Can Edit Change

Can Edit Demand

Allow Misc. Cash Receipts

Allow A/R Cash Distribution

Allow Apply Late Charges: This setting is disabled by default.

- Modify these permissions as described in the OpenForms Designer documentation.

Note: Permissions must be defined separately for every combination of Security Type, Profile, and Role or user.

- Click Save if you have made any modifications.

Creating a Voluntary Payment

Voluntary Payments are created on the Cash Collection > Payment Data Entry form. The steps to creating a voluntary payment transaction are similar as those for a standard payment. The following difference applies.

When you create a Voluntary Payment, you need to enter the subsystem (either Real Property Tax or Personal Property Tax), the year, and the cycle code for the payments that you want to create.

For example, the following parameters could be entered for an advance or Voluntary Payment for Real Property taxes.

- Subsystem: Real Property Tax

- Year: 2018

- Cycle Code: Municipal Tax

If a record matching the search criteria exists, it is displayed under Distribution. If no record exists for the year, one is created. A Voluntary Payment can be created for any year.

The record is displayed under Distribution.

Overview of the Voluntary Payment Transaction Process

The steps for creating a Voluntary Payment transaction are:

- Selecting the Deposit Number for the Voluntary Payment

- Performing the Search

- Completing the Payment Parameters

- Running the Cash Collection Wizard

- Viewing the Payment in A/R Inquiry

- Posting the Payment

- Viewing the Posted Payment in A/R Inquiry

Selecting the Deposit Number for the Voluntary Payment

The following procedure is mandatory. All A/R transactions in Govern OpenForms must be associated with a deposit number.

- Launch Govern.

- Open a Profile that contains Cash Collection.

- Open the Cash Collection form.

- Select the Deposit Management tab.

- Create a new deposit number or select an existing one.

The Transaction Type must be Payments.

Creating the Voluntary Payment

To create the Voluntary Payment transaction on the Cash Collection form:

- Select the Payment Data Entry tab on the Cash Collection form.

- Click New.

The deposit number you selected on the Deposit Management tab is entered automatically in the Deposit Number field.

- Select Voluntary Payment from the Transaction Type field.

- Select the subsystem from the Subsystem drop-down list.

- Only Real Property Tax and Personal Property Tax are available.

Enter a year in the Year parameter.

This is the year of fiscal year during which the transaction is applied.

For example, if you are creating an advance or Voluntary Payment for a 2018 tax bill, enter 2018.

- Enter the cycle code in the Cycle Code parameter.

The Cycle Code is mandatory for the Real Property Tax and Personal Property Tax subsystems.

Performing the Search

You need to perform a search using a Dynamic Search group and criteria.

To perform the search:

- Select a Search group in the Search section.

- Enter the required criteria in the Criteria section and click Enter on your keyboard.

If a record matching all the search criteria is found, it is displayed under Distribution. If no record is found, one is created and displayed under in the Distribution section.

An A/R barcode is created for the transaction.

Completing the Voluntary Payment Distribution Parameters

To complete the transaction, you need to enter the effective date and the amount. The effective date is the date that the payment is effective. By default, this is the current date.

A voluntary payment is effective before it is applied on a tax bill.

To complete the Payment Distribution parameters:

- Select the effective date of the transaction in the Effective Date parameter.

- Select a transaction and enter the amount of the voluntary payment in the Amount field.

Completing the Payment

Once you enter an Amount in the Amount field beside the record, it is automatically entered in the Money section. You can select the method of payment, such as cash, check, certified check, credit or debit.

You can enter multiple payment types. For example, a payment can be made partially by credit card and partially by check.

To complete the payment:

- Select a method of payment in the Type drop-down list.

- Enter an amount if it is different from the displayed amount.

- Enter a reference, such as the check number in the Reference field.

- Repeat steps 1 to 3 as required if there are multiple payment types.

Payer

All Cash Collection transactions must include payer information.

To add payer information to the transaction:

- Click the ellipsis button in the Payer Name section of the Cash Collection form.

- Do one of the following:

Click Search to search for a name in the database.

Click New Name to add a name that is not in the database.

If you want to add the name and address account directly, the Name and Address form must be included in the Profile.

- Click New Payer Name to a new payer.

Launching the Cash Collection Wizard

The Cash Collection Wizard launches automatically when you click the Save button.

To launch the Cash Collection Wizard:

- Click the Save button on the Cash Collection form after completing the payment.

The Cash Collection Wizard opens.

The payment amount and type are displayed.

- Collect the payment and click Next.

The full amount and payment type are displayed.

- Click the Print button to print the receipt.

Print Receipt

The Print Receipt can be customized. The default receipt is shown in the following screen shot.

Finishing the Payment

To finish the transaction:

- Click Finish. on the Cash Collection Wizard once you have printed the receipt and the transaction is complete.

The completed transaction is displayed on the Cash Collection form.

- Hover your mouse over the transaction to view the barcode.

Viewing the Voluntary Payment Transaction in A/R Inquiry

You can view the Voluntary Payment transaction, once it is saved, directly in the A/R Inquiry form.

To view the Voluntary Payment transaction in A/R Inquiry:

- Do one of the following, according to your setup:

Open the completed transaction in the Cash Collection form and double-click on the transaction.

Launch the A/R Inquiry form and perform a search using the barcode of the transaction.

The Voluntary Payment and Open Cash Credit transactions are displayed in the A/R Inquiry Detail.

Posting the Voluntary Payment

A Voluntary Payment can be posted, as any other Cash Collection Payment, with the Cash Collection Posting batch process.

Prerequisites

Ensure that you have access to the Department responsible for the A/R transaction.

Running the Batch Process

To post a voluntary payment:

- Launch Govern.

- Open a Profile that contains the Cash Collection Posting batch process.

- and through which you can access the required A/R transaction.

- Select the Batch Process Explorer.

- Select the Cash Collection batch process.

- Select the Voluntary Payment.

- Click Run.

- Click the Processing tab to view the batch process logs.

For details, see Cash Collection Posting.

Viewing the Posted Payment

Once the payment is posted, you can view the Voluntary Payment and Open Cash Credit transaction on the A/R Inquiry form.

To view the Voluntary Payment transaction in A/R Inquiry:

- Do one of the following, according to your setup:

Open the completed transaction in the Cash Collection form and double-click on the transaction.

Launch the A/R Inquiry form and perform a search using the barcode of the transaction.