Overview

Typically, refunds are created when there is an overpayment or duplicate payment. The Refunds screen includes the following sections:

General Information: showing the subsystem, fiscal year, bill, invoice, and check number

Detail: for the entry date, effective date, A/R Class code, installment, amount and discount date

Comment: for the justification code and any notes applicable to the adjustment.

Payer Information: displaying the name of the taxpayer and a code to identify the type of letter to be sent.

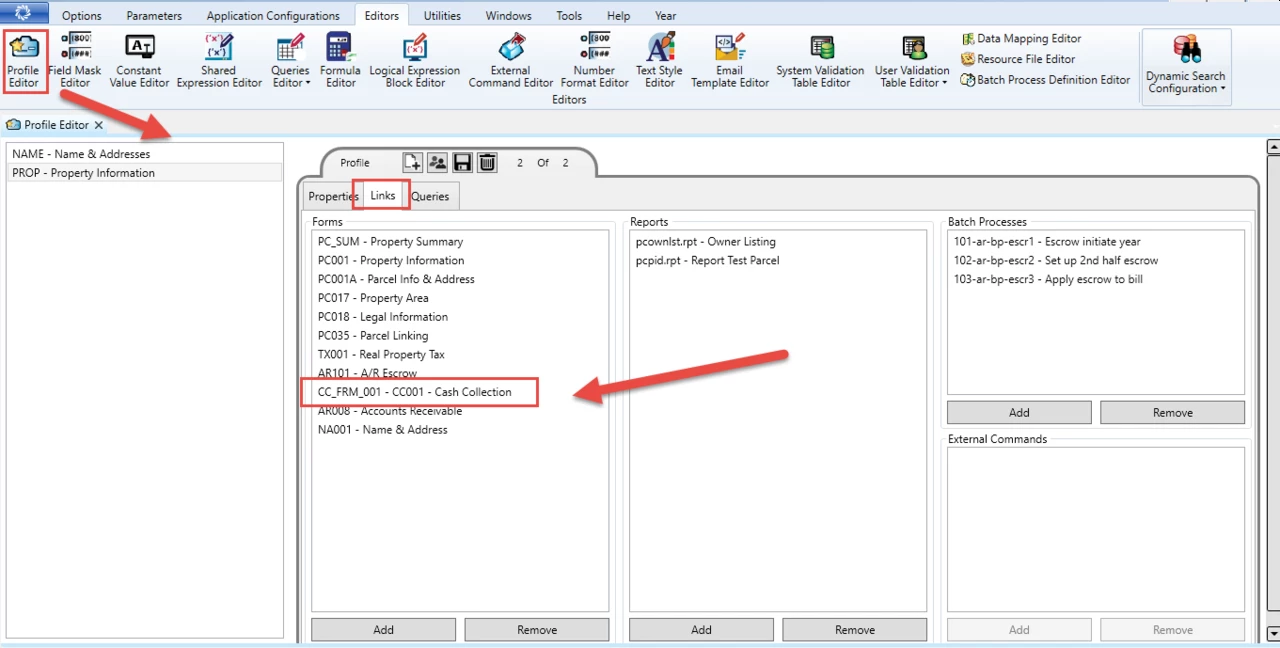

Accessing the Refunds User Form

To access the Refunds form.

- Launch Govern.

- Open a Profile that includes the A/R Inquiry.

- Open the A/R Inquiry form.

- Perform a search and select the required record.

- Right-click on the required record in the Summary section.

- Select Refunds from the drop-down list

The Refund Selection form opens.

- Select the record you are refunding and click OK.

If the record is for an overpayment, a message appears:

- Click Yes to display only the overpaid portion in the Amount text box.

Click No to display the full amount of the payment.

The Refunds form appears:

Icons

Save: Click Save to save a new or modified adjustment record.

Cancel / Exit: Click Cancel or Exit to close the form. A confirmation message is displayed.

Click Yes to save your changes. Click No to close the form without saving your changes. Click Cancel to stay on the form.

General Information

Subsystem: This field displays the subsystem for the record selected on the A/R Inquiry form.

Year: This field displays the fiscal year of the transaction.

Bill Number: The bill number for the selected A/R Inquiry record.

Invoice No.: Enter an invoice number for the adjustment.

Check No.: Enter the check number for the refund.

Check numbers for refunds can be created in any of the following ways:

- Generated by the Generate Refund Check Numbers batch process

- Automatically generated when a new refund transaction is saved in Govern

- Manually entered when a new refund transaction is created in Govern

The Check No. field is displayed if the check number is created either automatically or manually from the Govern user form.

You can enter a check number in this field or leave it blank. If it is left blank, this field is automatically populated when the record is saved.

The Check No. field is not displayed if you are using the Generate Refund Check Numbers batch process to create numbers for refunds. In this case, you must run the Generate Refund Check Numbers batch process in order to create check numbers for your refunds. A setup is required if you are using the batch process. See Generate Refund Check Numbers.

If the check number is created automatically either when the record is saved or when the batch process is run, it comprises the previous check number and the cycle. To create a new check number, one is added to the previous number.

Cycle Code: The Cycle Code associated with the record (Table: VT_USR_ ARCYCLE).

It is mandatory to create A/R Cycle Codes for Real Property and Personal Property tax billing. This is used for tax billing cycles and is linked to the A/R Class Code in GNA. You need to set up at least one Cycle Code, but you can create multiple codes. For example, you could have one cycle for municipal tax and a second for school tax.

Frozen IDs are created for cycle billing. A new Frozen ID is assigned when you run the Posting to A/R batch process. This is called a Certified Record. It is displayed in the Govern History Panel with the Cycle Code. The first Certified Record is assigned Frozen ID -1, the second -2, the third is assigned -3, and so on if there are multiple cycle codes.

A new Tax Audit record is created for all the parcels included in the batch process. The Entry Code for these records is set to Original. The Frozen ID is updated and a new entry is listed in the History Panel. For further details, refer to the Govern Real Property Tax documentation.

Detail

Date: The entry date for the refund. By default, this is the current date. To change the date, click the calendar beside this field and select a new date.

Effective On: The date the refund becomes effective. To enter a date, click the calendar beside the field and select a new date.

Amount: Enter the value of the refund.

If the refund is for an overpayment, this field displays either the overpaid portion or the entire payment, depending on the option selected on the initial screen

Interest: This field displays interest accumulated on the amount.

Total to Refund: This field displays the total amount to refund. By default, it displays the value in the Amount field. Enter a new value if required.

Class Code: Select an A/R Class Code from the drop-down list (Table: VT_ USR_AR_CLASS).

From Installment Number: Select the installment period for the refund: first, second, third, fourth installment or total (Table: VT_SY_ INSTALL).

Due Date: Click the calendar icon beside the Due Date field and select the date the refund is due, if applicable.

Discount Date: Click the calendar icon beside the Discount Date field and select the final date for a discount on the refund.

Comment

Justification Code: Select the Justification Code to explain the reason for the refund(Table: VT_USR_ARREASON).

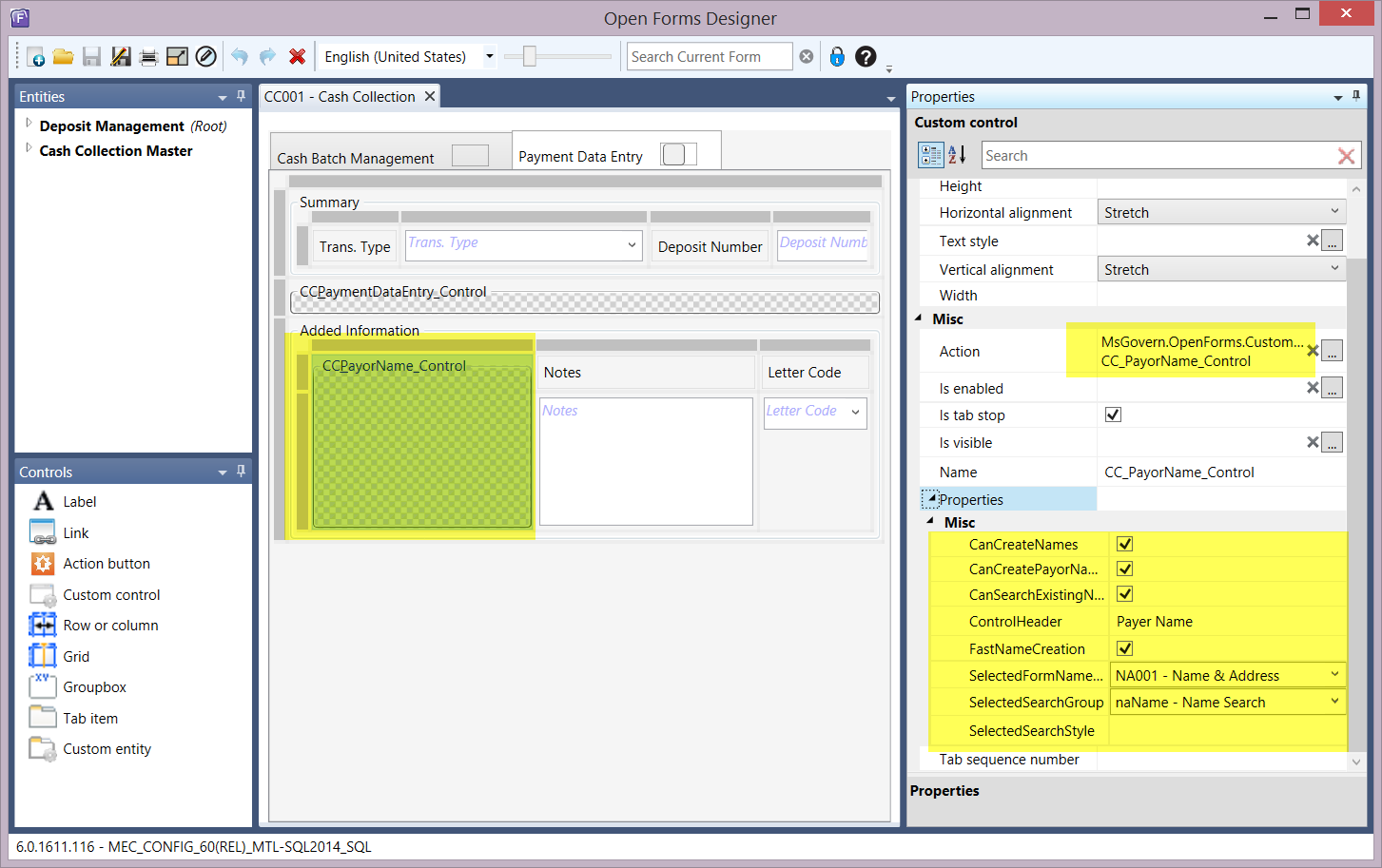

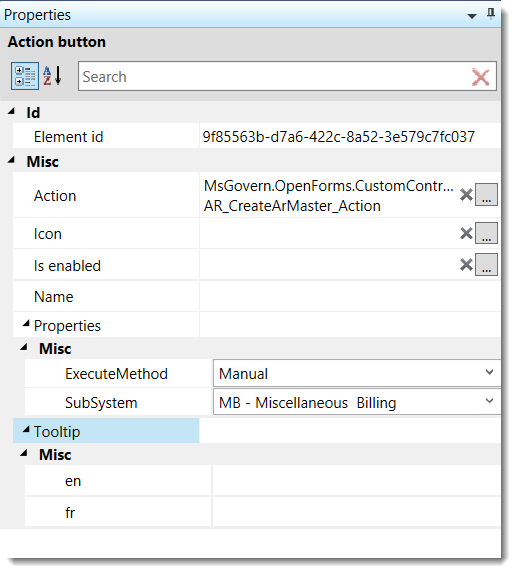

Deposit Number: Depending on the options selected in GNA, deposit numbers can be automatically generated or user-defined.

Automatically generated deposit numbers are composed of one or two of the following fields: date, last deposit, and user ID. This number can be modified if security permissions allow.

If Deposit Management is activated, a drop-down list is added to the Deposit Information parameter. This is populated by the deposit numbers created in the Deposit Management form. See Deposit Management.

Do one of the following:

- Enter a new deposit number required.

- Select a deposit number from the drop-down list.

Notes

Enter any notes or comments applicable to the adjustment.

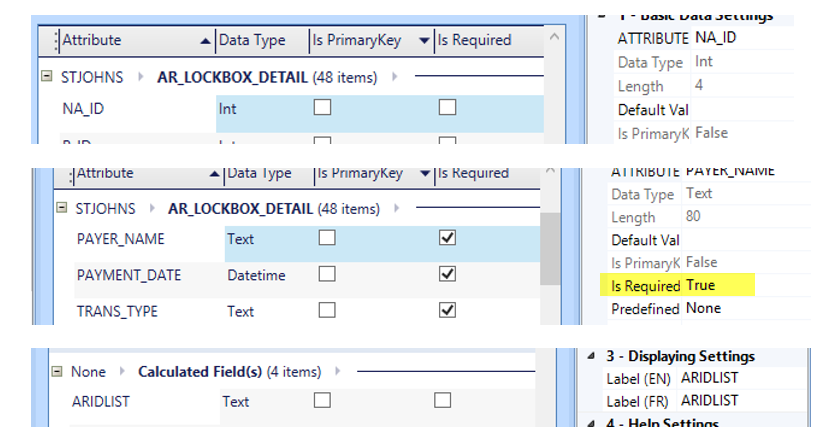

Payer Information

By default, the Payer information fields display the name of the taxpayer and a code that identifies the type of letter to be issued with the bill.

To modify the payer information:

- Click C beside the Payer information field to change the name. This displays the Search screen with the following options: By Name ID, By Tax Payer Account Number, By Name, By Phone Number, From NA_External

- Enter the required information on the search screen. Then select the applicable record.

- Select a code from the Letter Code field to identify the type of letter the payer receives, such as, duplicate payment, over payment or payment reversal (Table: VT_USR_LETER_C).

- Click Save.

A/R Inquiry for Refund

The record is displayed on the A/R Inquiry form when the transaction is complete.

The Amount and Payer Name fields under Cash Flow displays further details when you hover the mouse over a specific transaction: